Know Your Plan: Health Insurance Terms Every Singaporean Should Know

27 Jun 2025

Health insurance in Singapore is designed to protect you from unexpected medical costs, but there are various types of health insurance for different purposes and distinct components within each type.

Insurance jargon can be confusing, making it challenging to understand its meaning. However, knowing the main terms used in health insurance policies can help you make informed decisions, whether you’re buying a new policy or reviewing your existing coverage.

Here, we break down some important health insurance terms that every Singaporean should know.

General Health Insurance Terms

- Premiums: Premiums are regular payments made by you to maintain your health insurance coverage. Premiums can be paid monthly, quarterly, annually, or as a single lump-sum payment.

- Sum insured: Sum insured refers to the maximum amount your insurer will pay you for specific benefits, i.e., the amount you will receive based on your policy coverage. In a Hospitalisation plan (Integrated Shield Plan), this might refer to daily ward charges or annual surgical limits. In a Critical Illness or Personal Accident Plan, the sum insured is the lump sum paid out to you (or your family) upon diagnosis, injury, or death. Knowing your sum insured helps you assess whether your plan offers enough protection for serious or prolonged health issues.

- Exclusions: Exclusions are specific conditions or treatments that your insurance policy will not cover. These may include pre-existing conditions (unless disclosed and accepted), cosmetic surgery, dental care, fertility treatments, experimental procedures, or injuries from high-risk activities. Exclusions vary by insurer and policy type, so it’s important to read the fine print.

Knowing what’s excluded can help you avoid unexpected claim rejections and select a plan that fits your lifestyle and needs.

Integrated Shield Plan (IP)

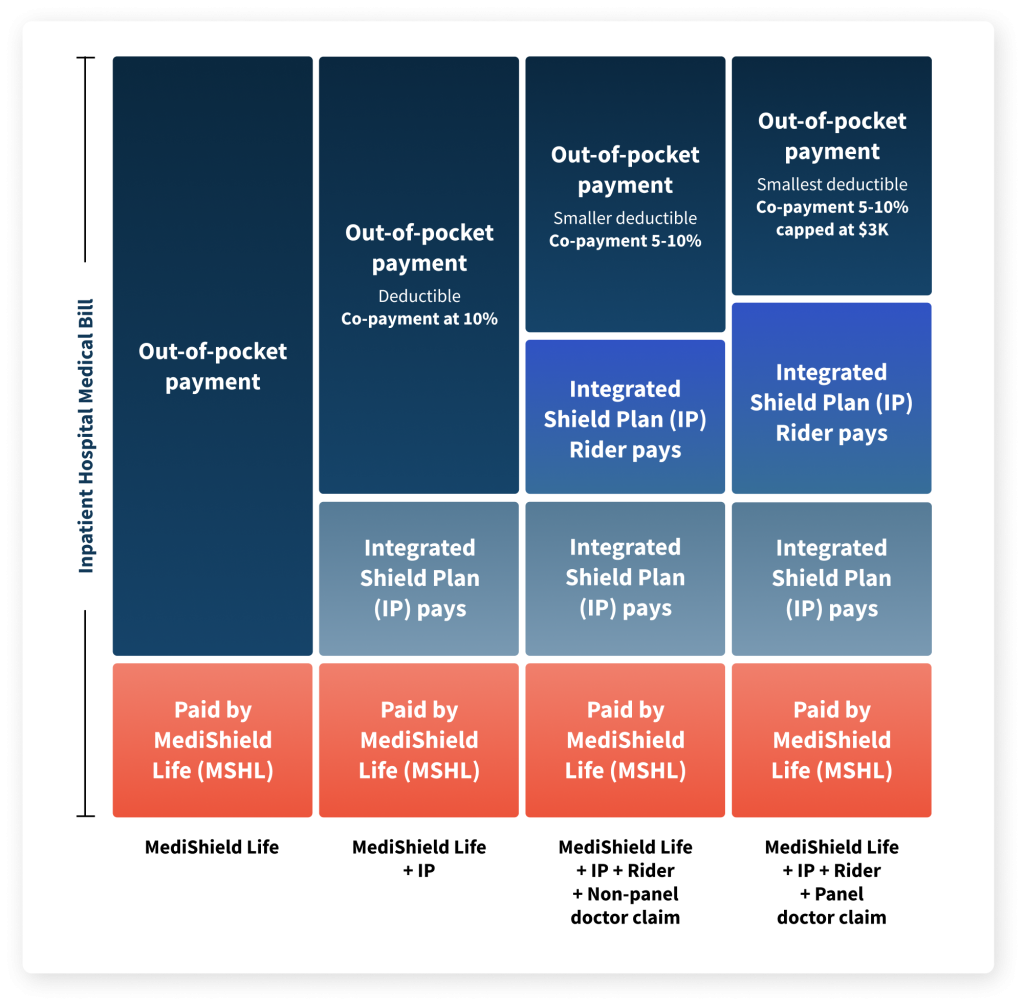

An Integrated Shield Plan (IP) builds on the basic MediShield Life coverage provided by the Singapore government. While MediShield Life helps with large hospital bills in public hospitals (Class B2/C wards), an IP extends your coverage, letting you choose higher ward classes or even private hospitals. It also provides longer pre- and post-hospitalisation benefits.

Offered by private insurers, an Integrated Shield Plan (IP) comprises two parts: the mandatory MediShield Life and a private insurance component. You can pay for both using your MediSave, up to annual limits set by the Ministry of Health (Singapore).

Key terms of Integrated Shield Plans

1. Deductible

A deductible is the fixed amount you must pay before your health insurance coverage kicks in.

For example, if your bill is $10,000 and your deductible is $3,500, you pay that first. Your insurer will then cover the remaining $6,500, subject to the co-payment terms.

Deductibles vary depending on your plan and hospital ward choice, and they help keep premiums manageable by reducing minor or unnecessary claims.

2. Riders

Riders are optional add-ons you can purchase to enhance your main health insurance policy.

Common riders for Integrated Shield Plans reduce your out-of-pocket costs by covering a large portion of your deductible and co-payment. Others may offer additional benefits like access to panel specialists, daily cash payouts during hospital stays, or overseas medical treatment.

Riders require separate premiums and cannot be paid with your MediSave. However, they can significantly reduce your financial burden in the event of hospitalisation.

3. Co-payment and Co-insurance

Co-insurance: Co-insurance is the amount you have to co-pay with your insurer after you have paid the deductible for your hospital bill. It is usually a percentage of the hospital bill (after deductibles). This is applicable if you do not have a rider. In Singapore, the co-insurance is usually 10-20% of your hospital bill after deductibles.

Co-payment: This is only applicable if you have a rider. In Singapore, co-payment is a percentage (typically ranging from 5% to 10% of the hospital bill) that you will need to pay, depending on your plan and any “co-payment rider” options you may have.

Understanding your co-payment helps you prepare for potential expenses and avoid bill shock.

Critical Illness Insurance

Critical Illness Insurance pays you a lump sum upon diagnosis of a major illness, such as cancer, heart attack, or stroke.

This payout is not tied to hospital bills and can be used however you need—whether to cover treatment, replace lost income, or pay for household expenses during recovery. Some policies cover early-stage illnesses, while others focus on advanced stages of the disease.

It’s a valuable complement to hospital plans, providing financial support at a time when you’re unable to work and focused on recovery.

Personal Accident Insurance

Personal Accident Plans provide financial protection if you suffer injury, disability, or death due to an accident.

Coverage includes outpatient medical costs (such as doctor visits after a fall), permanent disability benefits, and accidental death benefits. Some plans also cover daily hospital expenses or specific injuries and illnesses, such as fractures, hand, foot, and mouth diseases, as well as food poisoning.

Personal Accident Plans are affordable and especially useful for active individuals, families with children, or those in physically demanding jobs.

Know Your Coverage, Before You Need It

Health insurance doesn’t have to feel overwhelming. By understanding key terms such as Integrated Shield Plans, deductibles, co-payments, riders, sum insured, exclusions, Critical Illness Plans, and Personal Accident Insurance, you will be better equipped to manage your out-of-pocket costs should the need arise and can more effectively plan your finances.

You can also review your current coverage with our Coverage Checker to see if you need additional coverage.