Pre- and Post-Hospitalisation Coverage in Singapore: What It Is and How to Maximise Your Benefits

03 Sep 2025

What is pre-hospitalisation coverage?

Pre-hospitalisation comprises tests, scans, and consultations that you may have to do prior to being hospitalised. The costs of these add up over time, so this is where pre-hospitalisation coverage comes in. Basically, it is coverage that pays for medical expenses that you incur before you are admitted to a hospital, as long as they are related to the condition you are ultimately treated for.

For example, scans or diagnostic tests linked to your hospitalisation. This can include specialist consultations, diagnostic scans, blood tests and any other sort of tests that can help your doctors identify what’s wrong and decide on the right treatment plan for you.

Most major insurers in Singapore provide coverage for a set period, typically around 90 to 180 days, before your hospital admission. The exact duration and scope of coverage will depend on your policy, so remember to check your plan details to avoid any surprises.

What is post-hospitalisation coverage?

Post-hospitalisation coverage kicks in after you’ve been discharged from the hospital, covering follow-up treatments and consultations related to the same hospitalisation episode.

Common examples of post-hospitalisation treatment include physiotherapy sessions, follow-up scans and consultations, and wound checks or cleaning.

For many insurers, this coverage lasts 90 days to 13 months after discharge. Some plans also differentiate between panel and non-panel doctors, with extended coverage often available only if you stick to your insurer’s panel network.

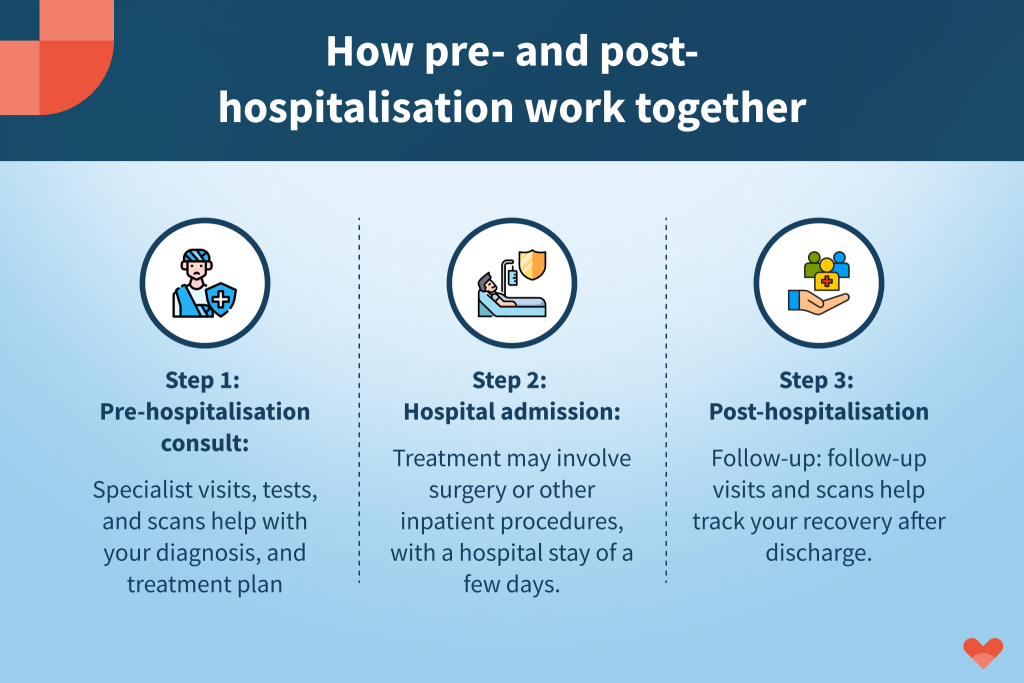

How pre- and post-hospitalisation benefits work together

Pre- and post-hospitalisation medical care are considered part of your whole treatment journey. Here’s what a typical claim journey might look like:

- Pre-hospitalisation consult: You see a specialist for symptoms, undergo diagnostic tests, and get a treatment plan.

- Hospital admission and treatment: You’re admitted for surgery or another major procedure.

- Post-hospitalisation recovery care: You attend follow-up appointments, scans, or physiotherapy sessions until you’re fully recovered.

For your claims to be approved, all bills must be clearly linked to the same diagnosis and hospitalisation episode. That means ensuring your doctor’s records clearly reflect that these treatments are connected.

Do pre- and post-hospitalisation benefits differ for panel vs non-panel doctors in Singapore?

Yes, it does. While most Integrated Shield Plans provide both pre- and post-hospitalisation coverage, the length of coverage and claim limits can vary significantly depending on whether you see a panel or non-panel doctor.

To incentivise policyholders to use doctors within their approved panel network, your insurer will typically offer longer post-hospitalisation coverage periods (e.g. up to 12 months) when you stick to a panel specialist. However, if you choose a non-panel doctor, your post-hospitalisation benefit may be shortened to 90–100 days, and in some cases, the reimbursable amount may be lower. The same applies to your pre-hospitalisation coverage window, though this varies by plan.

If you want maximum coverage before and after your hospital stay, stick to your insurer’s panel where possible, especially for long-term follow-up treatments like physiotherapy, wound care, or recurring specialist consultations.

Insurer/Plan | Pre-hospitalisation Coverage | Post-hospitalisation Coverage |

|---|---|---|

AIA HealthShield Gold Max A | As charged, up to 13 months (panel); 100 days (non-panel) | As charged, up to 13 months (panel); 100 days (non-panel) |

Great Eastern SupremeHealth P Plus | As charged, up to 90 days (non-panel); 180 days (panel/restructured hospital) | As charged, up to 180 days (non-panel); 365 days (panel/restructured hospital) |

HSBC Life Shield | As charged, up to 180 days | As charged, up to 365 days (panel/extended panel); 180 days (non-panel) |

Income Enhance IncomeShield (Preferred) | 180 days (panel); 100 days (non-panel) | 365 days (panel); 100 days (non-panel) |

PRUShield Premier/Plus | As charged, up to 180 days | As charged, up to 365 days |

Singlife Shield Plan 1 | As charged, up to 180 days | As charged: 365 days (panel); 180 days (non-panel) |

Key things to watch out for

While these benefits can be generous, there are important details to keep in mind:

- Panel vs non-panel doctors: Choosing a non-panel doctor may mean shorter coverage or lower claim limits.

- Pre-authorisation: Some insurers require approval (pre-authorisation certificate) before certain treatments; others don’t.

- Claim limits and sub-limits: Your plan may cap how much you can claim for certain services.

- Coverage exclusions: Visits unrelated to your hospital stay won’t be covered. For these, consider tapping into your corporate insurance (if available) for specialist outpatient visits.

Can corporate insurance help with pre- and post-hospitalisation?

Yes, of course. In some situations, your corporate health insurance can provide extra support beyond what your personal Integrated Shield Plan covers.

For example, if your pre- or post-hospitalisation expenses fall outside the typical coverage period (e.g. you need specialist follow-ups more than 12 months after discharge), your Integrated Shield Plan may no longer cover these bills. This is where corporate insurance can step in. Many company-provided plans include coverage for outpatient specialist consultations, diagnostic scans, and follow-up treatments, even if they are not directly tied to a hospital admission.

By tapping into your corporate insurance for extended follow-up visits or unrelated specialist care, you can reduce your out-of-pocket expenses while keeping your personal plan benefits intact. Just keep in mind that corporate coverage varies widely across employers, so it’s best to check your company’s policy terms.

How to maximise your coverage

To get the most out of your pre- and post-hospitalisation benefits:

- Keep all receipts and medical reports, you’ll need them for your claims.

- Ask your doctor to note the connection between your follow-up care and your hospitalisation.

- Use your insurer’s panel doctors where possible, especially if you want extended coverage.

- Submit claims promptly to avoid missing deadlines.

As long as you have the right Integrated Shield Plan, pre- and post-hospitalisation coverage can take care of the costs before and after your hospital stay, leaving you to focus on the most important thing, getting better. If you’re not sure about your existing coverage, use our Coverage Checker to check on your plan now.